An alliance for open and transparent land data systems and inclusive land governance: A global picture and country actions

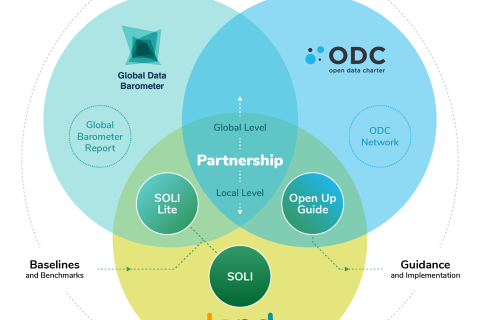

The Land Portal, Global Data Barometer, and Open Data Charter are working together at the nexus of open data and land governance. This blog shares how we are bringing our complementary expertise and passions for more open and transparent land data systems.

The problem

The Perceived Conflict Between Open Data and Privacy Concerns in India

The good governance of land is critical to the pursuit of sustainable development. Given that the land sector is often considered to be susceptible to corruption, open and transparent land data is seen as an opportunity to fight corruption. Following global trends, the land sector is increasingly engaging in efforts to make more land and spatial data open and freely available.

Land Portal featured in the Global Data Barometer blog

Towards more inclusive land data infrastructures: The work of the Land Portal

The Land Portal Foundation is Global Data Barometer’s (GDB) partner, which provided key input and support to develop the land module. The Land Portal works to develop an open land data ecosystem to improve decision making and policy through making land data and information more accessible and available.

Interview with Javier Molina Cruz: Taking the VGGT to the Next Level

Over the past nine years, the project on Supporting Implementation of the Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests (VGGT) has helped countries make political commitments towards the eradication of hunger, food insecurity, and malnutrition, with the explicit outcome of increasing awareness among decision makers, development partners, and society at large regarding access to natural resources. The Food a

How do we channel the ESG investment boom towards low-income countries?

Private financial flows that are tracked against certain Environmental, Social and Governance (ESG) criteria reached record highs in 2020. But this boom may not be having a material impact, especially in low-income countries (LICs) which are most in need of it. Identifying and managing unknown financial risks can help re-balance the risk-reward ratio for sustainable investors.

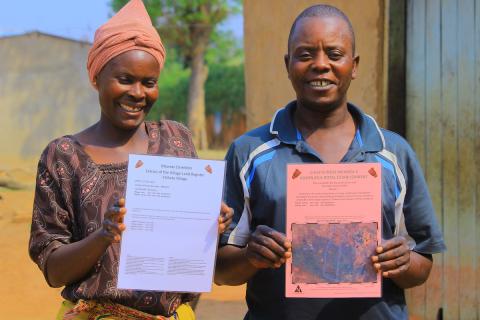

Zambia Launches National Land Policy

Zambia’s launching of a National Lands Policy on 11 May 2021 represents an important achievement after almost two decades of periodic drafting, consultation and validation attempts.

The advantages and implications of "soft law" instruments like the VGGT

Instruments like the Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests in the Context of National Food Security (VGGT) are "voluntary", i.e., legally non-binding. These instruments are intended to have a direct influence on the governance of the tenure practice of states by providing an internationally recognized set of principles, and by simultaneously encouraging good practices.

Enhancing responsible agricultural investment: What role should investment incentives play?

In the Mekong region, agriculture (including forestry and fisheries) employs over 43% of the population and contributes to around 16% to the regional GDP, making it an important sector for investment. Agricultural investment can be key to support economic growth, enhance food security and nutrition and reduce poverty, thereby contributing to the Agenda 2030. Yet, this investment must be responsible to generate sustainable benefits.

Comparative analysis of the legal frameworks in the context of responsible land-based investments: Cambodia, Lao People's Democratic Republic, Myanmar and Viet Nam

The recognition of customary tenure systems and responsible land-based investments that safeguard legitimate tenure rights and right holders are the interconnected main themes for mainstreaming the principles and internationally recognized good practices of the Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests in the Context of National Food Security (VGGT) in Cambodia, Lao People's Democratic Republic, Myanmar and Viet Nam.

Demystifying FPIC

During Session 3 of the 3rd Mekong Regional Land Forum, we will talk about free, prior and informed consent (FPIC) standards, with the intention to address common concerns of government agencies and private investors about perceived challenges and risks in relation to FPIC application. The session will highlight why FPIC is actually in the best interest of all stakeholders.